Dear greytHR Support Team,

I hope you are doing well.

I am seeking your guidance and clarification regarding gratuity eligibility under the Payment of Gratuity Act, 1972, in relation to CTC structure.

Background:

I recently completed my exit formalities from my organization and initiated a request to HR to process my gratuity. My employment details are as follows:

-

Employee Name: Lakshminarayanan S

-

Date of Joining: 25 June 2020

-

Last Working Day: 3 December 2025

-

Total Continuous Service: More than 5 years

My Request to HR:

I requested HR to initiate my gratuity process as I have completed more than 5 years of continuous service.

HR’s Response:

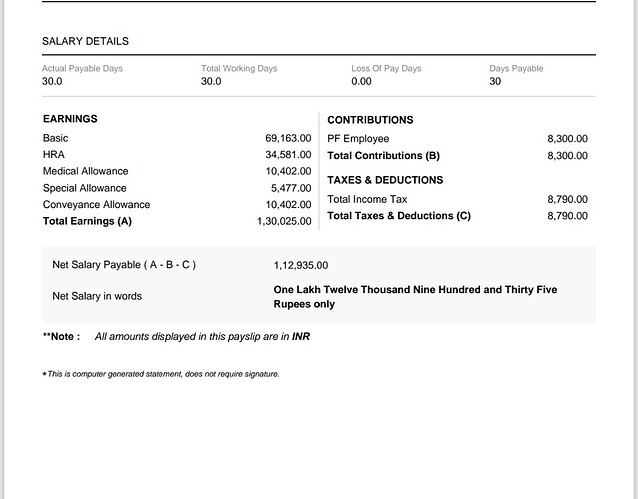

HR replied stating that the company’s CTC structure does not include a separate gratuity component, and advised me to refer to my payslip breakup for understanding.

Clarification Required:

I would like your expert guidance on the following points:

-

As per the Payment of Gratuity Act, 1972, is gratuity eligibility dependent on whether it is shown as a component in the CTC or payslip?

-

Can an employer deny gratuity to an employee who has completed 5+ years of continuous service solely on the basis that gratuity was not included in the CTC structure?

-

From a statutory compliance perspective, what is the correct approach an employer should follow in such a scenario?

I am seeking this clarification purely to understand the correct legal and payroll compliance position and to proceed appropriately.

Thank you for your time and support. I look forward to your guidance.

Warm regards,

Lakshminarayanan S